Blue and Co CTORG01 2022-2024 free printable template

Get, Create, Make and Sign

Editing tax organizer online

Blue and Co CTORG01 Form Versions

How to fill out tax organizer 2022-2024 form

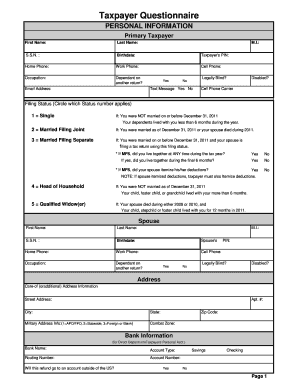

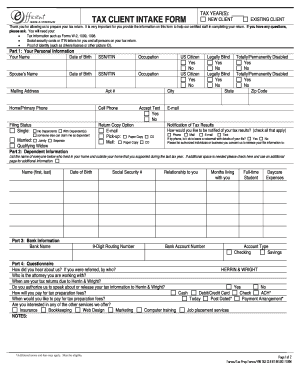

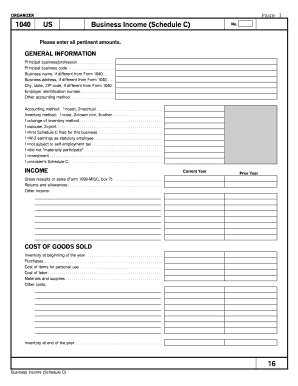

How to fill out 2022 tax organizer pdf?

Who needs 2022 tax organizer pdf?

Video instructions and help with filling out and completing tax organizer

Instructions and Help about tax organizer pdf form

Are you stressed out about getting ready for tax time stay tuned for today's two-minute tip brought to you by Smith each year shortly after the new year has arrived people begin bemoaning the fact that tax time will be here before you know it in January get a little nervous Plano tax time coming up most will also admit it wouldn't be such a dreaded task if they had kept track of things like receipts and other documents throughout the year instead of waiting until tax time to try and find everything my problem is, but I'm a procrastinator and I tend to wait to the last minute Smith all-in-one income tax organizer is a great way to organize and store your tax documentation and take some stress out of tax time the all-in-one income tax organizer comes with a handy instruction sheet checklist as well as preprinted and blank labels, so you can tailor the file to meet your needs as you accumulate various forms receipts and financial reports from banks investments and lenders keep them separated by category in the 12 roomy pockets so you or your tax preparer can find the information easily the all-in-one income tax organizer even has an extra large pocket to store your completed tax returns and the flap and cord closure keeps everything securely together and makes transporting the file easy keeping your tax records organized may seem daunting but if you keep your supporting documents organized throughout the year completing your return goes much faster and easier I've to try to get all my documents together and give that all-in-one tax organizer a try want more information check out all our tax time organizing tips and a handy tax time checklist ATS me calm / organ AAM OCK's like this video subscribe to speeds YouTube channel you

Fill fillable tax organizer : Try Risk Free

What is client tax organizer?

People Also Ask about tax organizer

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax organizer 2022-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.